February 26th, 2014

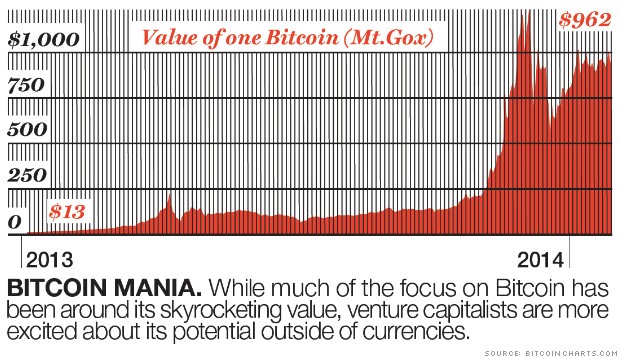

Via Fortune magazine, a careful look at Bitcoin which some people believe may be the future of money and others believe that it is merely nerd delusion. The article notes that neither is really correct:

Unfortunately, this debate is focused on the wrong thing. Bitcoin’s primary significance is not about whether it supplants cash. It’s about a revolutionary computer-science breakthrough that has the potential to upend all sorts of established industries.

Here’s an analogy: Email was the Internet’s original application, but 40 years later we all recognize that the Internet has countless more uses than just the electronic exchange of text. Likewise, currency is Bitcoin’s original application, but Bitcoin will not ultimately be defined by currency.

The key to Bitcoin is that it enables verified transactions without requiring a centralized third party to do the verifications. Kind of like the difference between handing a merchant a $10 bill and handing him a Visa card. It does so via what computer scientists call a distributed ledger, in which users are entering (or exiting) a fixed number of ledger slots (i.e., the “coins”).

This system could obviously present a major challenge to the existing payment industry, which includes all sorts of intermediaries like banks, credit card companies, and wire-transfer services. Not only does Bitcoin dramatically lower the fees for making and receiving payments, but it also eliminates both consumer fraud (from the merchant’s side) and the possibility of information theft (from the consumer’s side, as we recently saw at Target). For context, the Boston Consulting Group reports that the global payment and transaction-banking business generated $524 billion in revenue last year — a figure that it expects will rise to $1.1 trillion over the next decade. Just imagine all the new businesses that could eat into that.

What’s really fascinating, however, is that the distributed-ledger concept has all sorts of theoretical applications that don’t specifically concern payments. Take identity, for example. What if you no longer needed a phone company to create phone numbers? Or what if your web searches no longer needed to go through Google’s servers? It sounds crazy, but few predicted that the technology behind email would eventually destroy record stores.

“There are so many things that currently exist only in the confines of centralized, larger institutions that could become targets of this,” says Anders Brownsworth, a Boston-area Bitcoin technologist.

Not surprisingly, a number of well-known venture capitalists are paying close attention to Bitcoin and Bitcoin-related startups (most of which, so far, focus on payments). Andreessen Horowitz, for example, has already invested nearly $50 million in the sector. Early Facebook investor Accel Partners recently helped lead a $9 million investment into a Bitcoin startup from serial entrepreneur Jeremy Allaire, while original Twitter backer Union Square Ventures is deep into a well-funded Bitcoin “wallet” company called Coinbase.

All these investors obviously hope to make money on their early Bitcoin deals. But it reminds me a bit of what Howard Anderson, founder of both the Yankee Group and Battery Ventures, said in 2006 about American venture capitalists investing in Chinese startups: “Most of the VCs I see going to China will get clobbered … They say, ‘Yes, we know all that. It’s the cost of joining the club.’ ” In other words, take an educational beating today so that you can succeed in the future.

VCs are playing a similar long game on Bitcoin because they recognize its ability to exponentially increase Internet functionality, both in payments and beyond. And in the end, they won’t care what currency they are paid in.

This entry was posted on Wednesday, February 26th, 2014 at 7:54 pm and is filed under Blog. You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.