November 19th, 2013

Via The Financial Times, a multi-part series on bitcoin:

1. When memory becomes money; the story of Bitcoin so far

Okay…

Requests have been made, so here is a quick “story so far” on Bitcoin. Consider this a perfect dinner party cheat.

First off, Bitcoin is best described as a virtual crypto/digital parallel currency that is completely decentralised and unregulated (for now) by the current powers that be. It is understood to be the brainchild of one Satoshi Nakamoto, whose identity is alleged to be an alias in its own right. Many people believe the paper behind the Bitcoin system to be some anarchic manifesto purposefully designed to disrupt and destabilise the current economic status quo.

The ferocious and vocal advocates of Bitcoin — who tend towards the Austrian Liberatrian side of the political spectrum — pitch the system as a viable alternative to the current monetary system due to its free-market roots and general freedom from government intervention. No potential for Bernanke debasement here. Unlike other independent non-government based fiat systems, which have historically proved fragile and volatile, as well as vulnerable to collapse time and time again due to lack of intervention, Bitcoin advocates claim that the genius of their system lies in its self-regulatory mechanism.

So how does Bitcoin self-regulate?

Unless you are a computer geek, an MIT grad or an algorithmic genius, it’s unlikely you will ever really understand (we speak for ourselves). Generally speaking, however, it’s fair to say that the regulatory system is related to the two ways you can acquire Bitcoins.

The first way is to create or “mine” Bitcoins for yourself, but the downside here is that it takes a lot of computer power (and know-how) to do this effectively*. The amount of CPU dedicated to Bitcoin creation is in a sense directly proportional to the number of Bitcoins in circulation. The more Bitcoins exist, the greater the CPU power needed to mine new coins — meaning there is only an incentive to mine new coins if and when the Bitcoin price is high enough to cover your computer costs.

There is theoretically also a possibility to hack, replicate or steal existing independent Bitcoin warehouses. However, there is a bit of game theory involved in the programme which encourages everyone to play the rules. The game theory works on the basis that if a major hacking did take place, this would only knock confidence in the system, crashing the price of all units, including the stolen ones, rendering the efforts to steal them pointless in the first place. All in all, there should always be a greater incentive to mine new coins and play by the rules — especially, if you have the tech know-how to hack stuff in the first place — than to hack or destabilise the system.

That’s not to say hackings have never happened. The last time Bitcoin prices went bubbly in 2011, prices crashed rather dramatically as soon as it transpired there was a lot more coin in circulation than demand due to one of the main internet depositories being hacked.

The other way to acquire Bitcoins is to buy existing units in the secondary market. The process is very similar to any over-the-counter market, and in many ways entirely identical to how FX itself trades. The market is open, and features many competing platforms. You can buy them for investment purposes, or you can buy them for transaction purposes. At the end of the day, you put your trust in the platform which holds your digital record of account. Much like anyone does when they transact with an FX platform, or any other third-party payment provider like Paypal.

If the provider of the digital warehouse collapses, is hacked, or simply operates risky or insecure infrastructure, you stand to lose the wealth you have digitally stored there just like at any other private institution — which also exposed to hacking risk.

The store-of-value therefore lies in the account, as well as the fact that a trusted third party can corroborate ownership of that particular account. The coins themselves are bearer instruments.

Bitcoin thus represents in many ways the ultimate fiat of all fiat currencies, since the system is entirely trust and rule based. What’s more, if the system collapses or fails to create enough coins to prevent deflation, or fails to regulate supply causing inflation — there is no third party obligated to intervene to hold up the currency’s value.

If you believe a currency’s value lies in its stability, Bitcoin represents the polar opposite of that sort of system.

It’s worth mentioning that the use of Bitcoin was first popularised in the murky underground universe of Silk Road – an online marketplace for illicit goods and services — where identity protection and non-traceability were key. Because Bitcoins are totally independent and not regulated by authorities, it proved the perfect monetary instrument for an anonymous community which had a mutual interest in maintaining anonymity as well as an alternative underground store of value.

The Bitcoin flaw

Bitcoins are in some ways reminiscent of black-market dollars in the communist era.

But remember, whilst these “eurodollars” proved a bit of a headache for US monetary authorities (that’s the reason why you have to declare how many dollars you are bringing in from abroad every time you enter the US), they didn’t really compromise the existing system, because the central bank was always able to adjust and regulate supply to meet its intended target.

In that sense it’s the target — in terms of the supply relationship to demand — that matters, and nothing else. If central banks work it’s because they allow for a fluid and responsive adjustment of supply. In that sense they create stability out of elasticity.

Bitcoin, on the other hand, lacks this regulatory shock absorber. Its supply is inelastic and volatile. Today’s frothy price speaks volumes for the obvious flaw in its supply structure. It’s responsive, but not responsive enough *because the rules ensure that Bitcoin supply expands at a predictable and steady rate no matter what.

Bitcoin advocates say inflexibility is the entire point because the aim is to create a liberated “real” currency whose value is determined solely by market forces.

While that may be true, they perhaps fail to appreciate that currency is not just about value, but about providing society with a stable wealth allocation system. Value itself lies in the eye of the collective beholder.

Of course, if it’s instability, volatility and speculation you’re after, Bitcoin is definitely the currency for you.

But remember the volatility associated with Bitcoin stems from its inherent inflexibility (the same problem, which happens to be associated with gold). A supply system which adjusts fluidly and dynamically, on the other hand, will always allow for better stability, a better store of value and fairer allocation all round.

That said, it’s understandable why the darker elements in society might feel threatened by an economic system that’s trending towards a more equitable distribution of wealth by means of government-controlled fiat systems. The threat is heightened further when governments are doing their best to counter the hoarding of wealth in concentrated pockets by means of “dilution” through processes such as quantitative easing.

These money-printing processes, after all, act as shock absorbers that dampen what would otherwise be inelastic monetary adjustment periods. Indeed, the greater the inflexibility, the greater the economic suffering.

Removing the inflexibility factor, however, inhibits market speculation, because speculators depend on inelastic environments for volatility and uncertainty.

So what is a market speculator to do in a world that’s being de facto nationalised, and de-volatilised, by the ultimate financial shock absorber of all time, the Bernanke put?

The idea of creating or talking up an alternative inelastic system which no Bernanke can ever touch or stabilise could be very appealing.

The ultimate irony of Bitcoin (from a fiat-sceptic point of view at least) is that when its supply eventually runs out — and there is allegedly a natural choke point at 21m units — the only course for Bitcoin wealth is either towards maximum wealth concentration — so a hugely deflationary “them and us” effect — or, alternatively, towards fractional reserve lending in the manner we are used to today.

Since Bitcoins are a “free market”, one would imagine that re-lending of the fractional sort could not be prevented if the demand for it was there. This has the potential to create a credit system on top of a decentralised fiat system, without a lender of last resort backstop.

So perhaps it’s better if central banks just start issuing digital/crypto currency directly instead?

Some other fast facts about Bitcoin:

- The ECB has looked into the “threat” from Bitcoin and concluded: “It is mostly the holders of the currency that face risks, including the risk of a complete loss of the monetary value. At present, in Europe no wider risks exist, such as to financial stability or price stability, but this would change if a scheme would become significantly large. “

- There is an easy way to short Bitcoins if you so wish.

- There are hedge funds dedicated to trading Bitcoin.

- Market speculation is rife.

- David Birch thinks the system is very simlar to the stone currency that was found in the island of Yap.

- Money is memory anyway, or as Narayana Kocherlakota wrote in Kocherlakota “Money is technologically equivalent to a primitive version of memory.

2. A crypto crisis or a crypto triumph?

No, that’s not a chart of Bitcoin. That’s Volkswagen’s stock price back in 2009, when the fruit machine play caused a meteoric and non-sustainable short squeeze in the German carmaker.

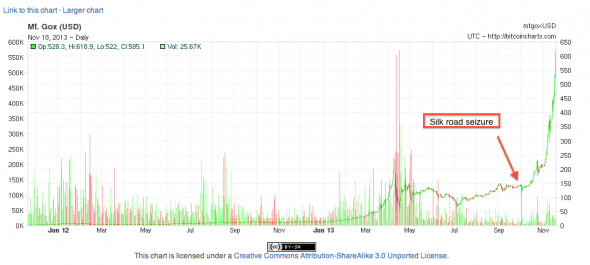

This, however, is the latest chart of the crypto currency from Bitcoin Charts, and it’s fair to say it’s beginning to look quite similar:

So is it the end of fiat currency as we know it, or just a mega short squeeze in an asset class that is by design intended to create short squeezes in itself?

Some points for your consideration with respect to evidence for the latter:

1) The FBI’s Silk Road seizure occurred on October 2, encumbering a large amount of supply. This immediately rendered many bitcoins unavailable to the market, creating a liability shortfall for anyone who was due those sums. Bitcoin is illiquid, so we should not be surprised that the market can get choppy.

2) A sinister cryptlocker virus has been spreading aggressively for more than a month. It hijacks computer systems and threatens to delete data unless a bitcoin ransom is handed over. Also, reports abound of a rush of purchases by unsophisticated and distressed buyers who are presumably ready to pay any price, and thus can be squeezed by more sophisticated players in the market.

3) Ironically for a price rise that fans insist is legitimising the crypto asset class, the move has coincided with a rush of Bitcoin thefts, hackings and exchange disappearances. Whether there is suddenly a major incentive to steal coins, or exchanges are simply unable to meet redemption requests due to liquidity issues, both circumstances are potentially indicative of entities being unexpectedly exposed to supply crunches, and a sudden inability to cover those liabilities.

4) This summer new mining technology entered the market, increasing operating margins significantly for those who had access to the tech. It was something of a shale mining boom for bitcoin miners. Except while in the real world mining efficiency leads to additional supply and a reduction in price, in the bitcoin world — because supply is kept constant, since all that happens is that the cryptology gets more difficult — leading non-efficient miners to pull out from mining.

The rise in the hash rate is indicative of how much more processing power is needed to successfully mine bitcoins:

Miners using new technology can cope with that increase, but for conventional miners the operating margins are reduced sizeably:

(Charts via Bitcoin Charts)

To keep conventional miners incentivised to stay in the mining operation — at least until everyone transfers to the new technology — the price has to go up instead. However, as the chart above shows, prices are not yet high enough to keep conventional miners in the game. The consequences of that, we would imagine, are that the mining peer network may have been greatly reduced, creating something of a cartel-like effect, due to the lack of competition.

The super spike suggests the market is now evolving to attract back conventional miners so as to defend the decentralised structure of the market from the destablising effects of miner concentration — more easily done now that there is a supply deficit which is potentially choking the system. But, as you’ve guess it, this can only be achieved through stratospherically higher prices (in line with the efficiencies that have been made) and/or the roll-out of the new technology to all miners.

All in all, these are conditions for a perfect and volatile storm.

This entry was posted on Tuesday, November 19th, 2013 at 4:48 am and is filed under Blog. You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.